“You come at the king, you best not miss.” — Omar Little

In a post back in August, I offered some thoughts on whether and how the U.S. could sanction China in the event of a conflict over Taiwan. My conclusion was this:

Because financial sanctions would have huge costs for the U.S. and its allies and a relatively muted long-term impact on China…I expect us to use a different, more targeted kind of sanctions [in a Taiwan conflict]: Export controls.

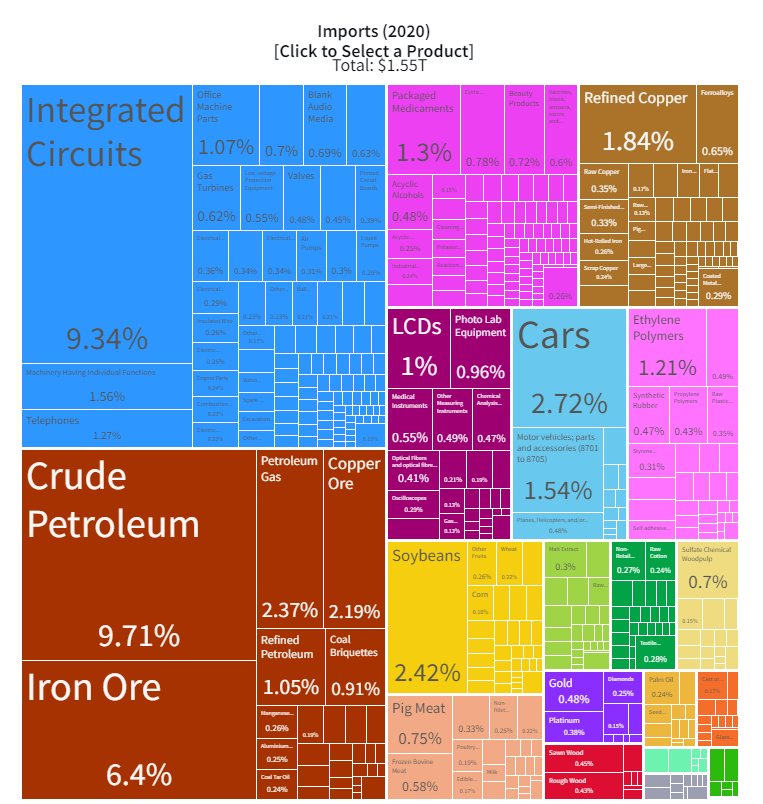

So what does China import a lot of, that would be crucial in any war situation? Computer chips, fuel, and raw materials…[C]omputer chips are essential for everything military. And although China is trying hard to ramp up domestic production, it has a long way to go.

So I have to say that I was fairly surprised to see Biden go ahead and just do this, without even threatening it in advance or waiting to use it as a bargaining chip. This week, the administration implemented sweeping export controls on China’s entire chip sector. There are three main changes:

1. A ban on the export to China of specialized chips used for AI, or equipment to make these chips

2. Restrictions on exports of high-end semiconductor manufacturing equipment to China

3. Making a new list of Chinese companies (the “Unverified List”) that can be quickly banned from buying various U.S. exports without a special license (moved to the “Entity List”).

The actions are being described as an “economic war”, and the phrase is not hyperbole. The primary purpose of these export controls is not to protect U.S. industry or to stop the leakage of intellectual property to economic competitors. Their purpose is to kneecap China’s semiconductor industry — to slow down the country’s push for technological self-sufficiency.

That push has a lot to do with why the Biden administration went ahead and did this now instead of waiting.

Why we’re doing this now

First, some background. China has become the workshop of the world — the “make-everything country”, in the words of researcher Damien Ma. Its manufacturing output rivals that of the U.S. and all of Europe put together. But it still imports lots and lots of computer chips, mostly from the U.S., South Korea, Taiwan and Japan.

Computer chips power everything these days, including everything military, so in the event of a war that cut off China’s supply of chips, the country’s vaunted manufacturing complex would be in trouble. Specialized chips, like AI chips and the processors used in supercomputers, are especially important to the areas of innovation where China is trying to push past the U.S.

For the past two or three years, China has been embarked on an all-out effort to build a domestic chip industry that can rival that of the U.S. and its East Asian allies (Taiwan, South Korea, and Japan). China’s effort has involved plenty of waste and mismanagement, but also some startling successes. China analysts have expressed confidence that the country would eventually be able to achieve its goal of self-sufficiency, probably more quickly than scoffing Americans expected.

This was probably why Biden took action now. If he had withheld the threat of semiconductor export controls as insurance against a possible future invasion of Taiwan, there’s a good chance that by the time China was ready to attack, it would have largely immunized itself against this economic weapon. In other words, as I wrote in my previous post, this was always a weapon with an expiration date. And the people in the administration, who are much better informed than I am about the details of China’s chipmaking progress, apparently decided that the expiration date was sooner than I had thought.

What really matters: Skilled engineers and advanced equipment

In terms of exactly how the kneecapping of China’s semiconductor industry is supposed to work, there’s a lot of focus on the restriction of actual chip exports, but in fact I think this is relatively minor. The real key commodities aren’t advanced chips themselves, they’re the things used to make chips. It’s like the difference between giving a man a fish and teaching him to fish.

And there are two basic things you need in order to make advanced chips:

You need to know how to make the chips (intellectual property).

You need specialized equipment.

The know-how of chip construction is mostly not contained in blueprints, or sets of instructions, or anywhere that can simply be sent to China by a spy. The know-how is mostly contained in the heads of the engineers who work for chip companies. So the best way to transfer that know-how is to simply hire American, Korean, or Taiwanese engineers to go work in China.

In fact, hiring foreign engineers to build up domestic industry has a long and storied history. One of the most famous examples, detailed in the book How Asia Works, was how Korean companies hired retired Japanese engineers to move to Korea and teach companies like Hyundai and Samsung how to make cars and electronics. Japanese companies, which traditionally give out promotions and raises based only on seniority, used to force workers into retirement at 60 to avoid having them become too much of a financial and managerial burden; this left them with a number of good working years left and nothing much to do. Korea took advantage, and soon Korean companies were outcompeting their Japanese counterparts.

China has been trying to do something similar, recruiting Taiwanese and Korean and American semiconductor engineers. The new U.S. export control regime attempts to put a damper on this practice, with a rule that U.S. citizens aren’t allowed to work in the semiconductor industry (my understanding is that we can do this because working for Chinese companies is deemed to represent an export of intellectual property to those companies).

This could potentially be devastating to Chinese companies that were relying on American management. Jordan Schneider, an analyst at the well-regarded Rhodium Group, wrote a well-read Twitter thread in which he translates another thread by a Chinese entrepreneur working in the U.S. A few excerpts:

Schneider is skeptical that the decapitation is as complete as described here. I tend to agree with that skepticism. For one thing, the “U.S. persons rule” doesn’t apply to Taiwanese or South Korean semiconductor experts, and those countries may choose not to follow the U.S. lead (If I were the Biden administration, I’d have people working furiously to persuade Korea and Taiwan on this front). Still, the blow seems likely to be a substantial one.

The second thing you need to build an advanced chipmaking industry is advanced chipmaking equipment. As you might expect, the new export control regime focuses heavily on banning exports of these machines to China. A lot of this equipment is made in the USA. But importantly, it’s a lot easier to force foreign companies to go along with this sort of sales restriction than it is to prevent foreign individuals from working for China.

The most well-known and most important example of this is ASML, the Dutch manufacturer of EUV (extreme ultraviolet) lithography equipment, which at present is the only way to manufacture the very most advanced chips. So far, the U.S. has successfully pressured ASML to avoid selling China EUV machines, while unsuccessfully trying to get them to stop selling older tech. Now, under the new regime, the U.S. will probably have a much easier time keeping ASML tech out of China.

It remains to be seen how easily and quickly China’s semiconductor manufacturers can find away around the one-two punch of personnel/IP cutoffs and equipment cutoffs. They will have to get much sneakier, and upgrade their own internal culture of innovation and human capital development at the same time.

A new global economic paradigm

Meanwhile, companies and governments outside China are quickly realizing that the global economic order has really and truly changed. There was much talk of decoupling during the Trump administration, but relatively little came of it. Part of this might have been because the Trump administration framed its restrictions as protectionism — the goal of tariffs, for example, was ostensibly to get China to buy more U.S.-made products. If the goal was to balance trade rather than to cut it off, that left the hope that restrictions might be lifted soon. And it also left room for American companies seeking to sell chipmaking equipment to China to argue against or seek exemptions from the restrictions — after all, they were exporting and lowering the trade deficit.

Biden’s export controls are a different animal entirely. The goal is not to benefit American companies, but to hurt Chinese ones, for reasons of national security. An administration official recently confirmed this explicitly. They simply care less about U.S. companies’ profits than the U.S.’ technological lead. In fact, the stocks of chipmakers like Nvidia and AMD already fell back in September, when it became apparent they’d be restricted from selling chips to China. But national security overrides the need for modestly higher profits for a few companies.

This is a return to the Cold War economic strategy, where the U.S. and its allies actively tried to limit exports of technology to the Soviet bloc. It’s the approach suggested by writers like Hal Brands, whose new book Danger Zone I recently reviewed. Brands himself cautiously praised the new restrictions:

In this sense, the new restrictions represent an awakening of sorts for Biden’s team, which once argued that America could outcompete China by being the best version of itself…Necessary as [initiatives to boost U.S. companies’] technological competitiveness] were, they did not address the fact that Chinese firms were using nearly unrestricted access to advanced chips and manufacturing equipment made abroad to support Beijing’s military buildup and surveillance state…

This is normal in great-power rivalry: It is hard to check a competitor geopolitically without also hamstringing it economically. The US is making a big move toward a strategy of technological containment. It won’t be the last.

Analysts who are more bullish on China tend to think that this economic warfare will be ineffectual. For example, in this thread, Samo Burja argues that China’s across-the-board competence in advanced manufacturing give it the decisive advantage:

But as Burja himself notes, China’s manufacturing abilities in many of these other categories also depends on importing certain specialized, high-value components from developed countries — the example he gives is reduction gears for robots. It’s possible that we’ll see the U.S. also try to halt exports of these key components — or hold out the threat of those restrictions as a punishment should China attack Taiwan.

In other words, U.S. high-tech companies — and companies from all developed countries — should realize that the China market is not nearly attractive as they thought it was. Even if the U.S. doesn’t decide to restrict exports of some high-tech product, China will now absolutely refuse to be dependent on a foreign supplier for that product. So if your business plan depends on selling some specialized, high-end machine tool or electronic component to China, you can probably just delete that plan right now. The great dream of finding riches in the Chinese market will increasingly be confined to producers of goods that neither side views as military useful — like luxury handbags, or soybeans.

High-tech companies relocating sales and operations out of China will also probably cause some of these companies’ suppliers and customers to follow suit. Economic agglomeration effects may soon act only within the world’s two great manufacturing blocs — one agglomeration in China and another in the developed world. From an economic standpoint, this is horribly inefficient, but in an era when war and the threat of war are stalking the globe, economic efficiency is hardly policymakers’ chief concern.

This dramatic action was clearly a tit for tat response to last week's Saudi oil decision.

Russia has very little bargaining power to effect the Saudi's decision. This move by Biden lends credibility to the possibility that it was really China that moved Saudi's hand. The fact that it was announced right before China's Party Congress is awfully symbolic too. (vs US midterms)

A trade war with China will not be good for US inflation.