The 8% interest rate scenario is still in play

Commodity prices are falling but inflation still isn't

It’s a strange time for the U.S. economy. Growth is low and quite possibly negative and consumer spending is slowing (Update: maybe not!), but employment is high and still surging, violating a long-standing pattern known as Okun’s Law that says that growth and employment should move more-or-less in lockstep. On the price side of things, we’re seeing disinflationary pressure, as commodity prices fall and supply chain snarls work themselves out.

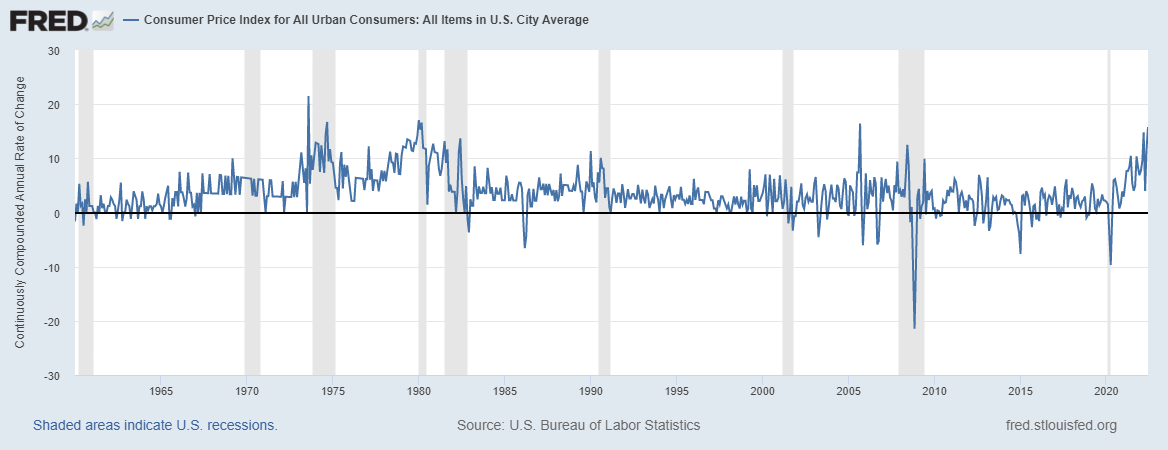

Falling commodity prices contribute to disinflation two ways — first, by lowering headline inflation, and second, by reducing costs for producers of other goods and services. Yet despite all these disinflationary pressures, inflation itself rose again in June. Headline inflation was 9.1% year/year, and a terrifying annualized 15.8% month/month. Core inflation was 5.9% y/y, almost exactly the same as last month, and 8.4% annualized m/m — slightly below the March peak, but still quite high. In terms of monthly headline inflation rates, we’re now right around the highest levels ever seen in the Great Inflation of the 1970s:

What the heck is going on? Well, maybe the disinflationary pressures just haven’t had time to work themselves through the system yet. Some commodities have been falling since the beginning of this year or even earlier, but oil and wheat — the two things most disrupted by the Ukraine war — only started falling in the last few weeks. So hopefully I’m writing this post for nothing, and in a month or two we can all breathe a sigh of relief as disinflation finally takes hold.

In fact, I still think that’s the likeliest scenario. But this month’s numbers show that we can’t count out the really bad scenario, in which the only way for the Fed to beat inflation is to raise rates really high — 8% or more. I talked about that in a post back in May:

The reason this bad scenario is still in play is that there are multiple kinds of inflation. And every month that prices go up despite tightening monetary and fiscal policy and falling commodity prices and wages, it increases the likelihood that we’re now in the really scary kind of inflation.

Three kinds of inflationary pressure we’re not experiencing now

Keep reading with a 7-day free trial

Subscribe to Noahpinion to keep reading this post and get 7 days of free access to the full post archives.