Another newsletter-type post today. First some travel blogging, and then on to a couple of econ debates.

Taipei urbanism: some first impressions

When I first set foot in Taipei, I had a disorienting sense of being back in Japan — so much so that I kept expecting people to drive on the left side of the street. So much of the infrastructure in Taiwan looks and feels Japanese — the pavement, the building materials, the signs at the airport. People cite this as a residue of the colonial period, but given that the colonial period ended 77 years ago, it’s probably more due to Taiwanese architects, urban planners, and engineers continuing to look to Japan for inspiration.

After a few minutes, however, the sense of Japan-ness faded, crowded out by two key features of the Taipei landscape: lush greenery and shabby building facades.

Taipei is much greener than any Japanese city I’ve seen — towering trees line thoroughfares, dense bushes sprout next to storefronts, vines and houseplants explode from balconies, there are patches of grass over which Japanese developers would have long ago poured concrete. This gives Taipei a very natural feel, unlike Japanese cities, which can feel like being inside a giant spaceship.

Conversely, where nearly every exterior surface in Japan looks immaculate and new, Taipei is filled with buildings that look like they haven’t been refurbished since the 1960s — bare concrete streaked with stains and pockmarked with crumbling patches, ancient window-shaker AC units sprouting from dingy balconies. There are plenty of new buildings too, but not enough to overcome the sense of lush decay that one gets whenever one looks up at the building facades. The overall aesthetic is that of a ruin in a rainforest.

This is all during the day, of course; at night you can’t see the towering concrete, and the electric signs light up, and the city acquires more of the standard “Asian megacity” feel of Hong Kong or Seoul.

At ground level, Taipei offers a unique shopping experience. The streets are lined with nice little shops and restaurants — and when I say “little”, I mean tiny even by Japanese standards. These are almost all on the first floor, as in most cities. Unlike the concrete facades of many buildings, these shops are fresh and cheery and clean and new-looking. There are far fewer boutique clothing stores than in Japan, but restaurants seem to largely make up the difference. The food is every bit as good as you’ve heard — eating is one of Taiwan’s favorite pastimes. Craft stores are also common, and the quality seems very high. I noticed quite a few jewelry stores, which seems odd in a country where everyone seems to dress down.

One innovation of Taipei street design is that there are covered sidewalks everywhere, presumably to protect from the sort of constant light drizzle that has suffused the city every day I’ve been here so far. Walking along shop-lined streets thus feels a bit like being in a covered shopping arcade.

Getting around Taipei is very easy. The central city is very dense and compact, comparable to San Francisco (though the municipality includes some outlying areas); many places can be reached on foot. The subway is convenient, though for some reason Google Maps keeps telling me to take the bus instead.

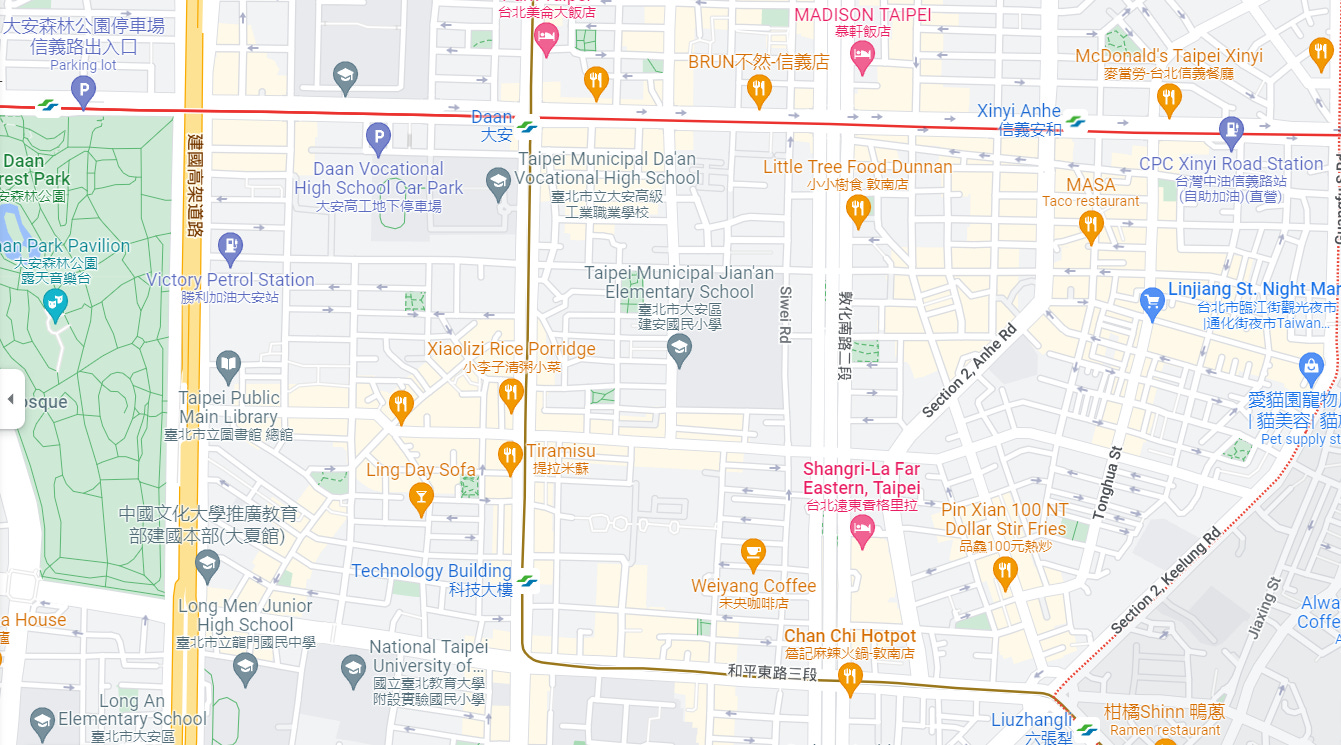

But the main way that people seem to get around in Taipei is on the roads. The city is a grid plan of huge thoroughfares with smaller, less regular streets filling in the gaps between:

This is a much different experience than walking through NYC or Tokyo. NYC is a dense grid of small-to-medium streets, while Tokyo is pretty much a mess of winding paths with only a few giant roads. Here’s a map of Ikebukuro, one of Tokyo’s downtown districts, on the same scale as the map above. You can really see the difference.

These different road layouts are probably one reason why Taipei feels a little more car-friendly and a little less pedestrian-friendly than Tokyo; in Taipei you’re never very far from a giant river of fast-moving cars.

The real kings of the Taipei streets, however, are the scooters. It seems like everyone in Taiwan has a scooter, and they move down the roads in giant floods:

Scooters also zoom down the side streets, which makes walking down these streets less comfortable than in Tokyo. In Japan, cars share the narrow side streets with pedestrians, but drivers move very slowly and defer to people on foot. In Taipei, scooters zoom down the side streets at pretty high speed, attempting to circumvent pedestrians without slowing down too much. This makes walking down Taipei side streets a little less comfortable than in Japan — you’ve got to stay a little more alert.

Scooters overall are not the safest mode of transport; Taiwan’s rate of traffic injuries exceeds that of the (unusually dangerous) U.S., and its death rate is about the same. You might think Taipei should switch to bicycles, but the high density of gigantic roads makes this difficult. Scooters also contribute to air pollution (though industry and electricity are bigger sources). The Taiwanese government should make a concerted effort to switch to electric scooters and cars, which would make Taipei’s air a bit nicer and reduce the sound from the big roads (though they’ll probably have to add some sound back in for scooters to make sure pedestrians can hear them coming). In the long term, though, I think Taiwan should try to shift from scooters to bicycles (including e-bikes), by providing protected bike lanes along big roads. They should also build out more trains, taking a cue from Tokyo.

Although I haven’t had a chance to gather a large sample yet, another difference between Taipei and Tokyo seems to be the size of the interiors; Taiwanese apartments are more spacious. Good data is hard to find, but most sources seem to confirm this. Overall, Taiwan seems to have done a decent job of ensuring affordable, abundant housing near the city center.

In any case, if you’re interested in Taipei’s urban layout and policies, I recommend this Twitter thread by the ever-excellent Alfred Twu:

I’ll be back with some more thoughts on Taiwan in general in about a week.

The heterodoxers vs. the Nobelists

Anyway, enough about Taipei for now; let’s talk about economics!

In the wake of every Econ Nobel award, there are always some people who criticize the choice. If the award goes to economists who are more empirical or applied, or draws from fields like psychology, the criticism tends to come from econ’s more math-heavy old guard, while if it goes to researchers who do traditional formal modeling, the shots tend to come from “heterodox” outsiders. This represents a fundamental tension between visions of what economics should be and what economists should do. The Nobel committee, to their credit, has simply shrugged and ignored the critics and decided that both are perfectly valid ways of doing economics.

This year, the award went to Ben Bernanke and Diamond & Dybvig, who created mathematical models of financial crises. So it’s unsurprising that a number of “heterodox” types jumped to criticize the choice. Some of the criticisms seemed not to have been particularly familiar with the Nobelists’ work, claiming that Bernanke ignored the fact that bank credit is endogenous (when this is the whole point of his papers), and dinging Diamond-Dybvig for saying that banks lend out a portion of deposits (which they do not actually say).

A more incisive criticism, however, came from economic historians. Adam Tooze argues that the prize celebrated the codifying of things we already knew into mathematical formats that didn’t really add any value:

[T]his year’s economics “Nobel” prize…has the effrontery actually to celebrate one of the weakest dimensions of modern macroeconomic thinking - its extraordinarily limited ability to grasp the macrofinancial instability of modern capitalism…

[T]he award [is] a gratuitous exercise in self congratulation on the part of a discipline that has huge difficulty in shoe-horning reality into its models…As Wolfgang Munchau rather unkindly remarked, the prize seems like a retrospective celebration of the heyday of “boomer macro”, the age, in the 1980s, when the new Keynesian synthesis of macroeconomics with microfoundations finally demonstrated to its own satisfaction that bank runs could actually happen and careers could be made, as Ben Bernanke’s was, by demonstrating, by way of a new take on the 1930s Great Depression, that finance might matter for macroeconomics. All this amidst the Volcker shock, the Savings and Loans crisis and the Latin American debt crises[.]

As Brad DeLong documents, this is similar to the criticism that Charles Kindleberger himself leveled at one of Ben Bernanke’s prize-winning papers in 1983:

I think you have provided a most ingenious solution to a non-problem. The necessity to demonstrate that financial crisis can be deleterious to production arises only in the scholastic precincts of the Chicago school with what Reder called in the last JEL its tight priors, or TP.If one believes in rational expectations, a natural rate of unemployment, efficient markets, exchange rates continuously at purchasing power parities, there is not much that can be explained about business cycles or financial crises. For a Chicagoan, you are courageous to depart from the assumption of complete markets.

Basically, what these critics are saying is that all Bernanke and Diamond-Dybvig did is to use the stilted, formalized math language of modern macroeconomic modeling to tell us what we already know from history — that economies are inherently vulnerable to financial crises and resultant recessions. Had a bunch of macroeconomists not come along in the 70s and 80s and demanded that all models be expressed in this stilted language, they argue, there would have been no need to do the research that was awarded with this year’s Nobel.

Paul Krugman begs to differ. In a Twitter thread, he argues that formal mathematical modeling, of the kind that Bernanke and Diamond-Dybvig did, adds significant value to the lessons of history. Some excerpts:

I score this debate about even. On one hand, Tooze and Kindleberger are absolutely right that the mathematical macroeconomists of the 70s and 80s did serious harm to economists’ ability to understand the world. By insisting that smooth-functioning, perfectly optimized free markets were the baseline, and that any instability or inefficiency in markets had to be explicitly justified with complex and highly formalized math, they biased the economics world away from considering the kind of dangers that ended up crashing the economy in 2008 (as well as various other threats).

Thus, a big part of the value Bernanke provided to the econ world was simply to undo part of the damage that these guys did. By jumping through the methodological hoops they erected, Bernanke gave the econ world permission to accept the bank rescue measures and recession-fighting measures he implemented in 2008-14. That’s worth a prize in and of itself, but it doesn’t speak highly of the econ profession — or at least, the econ profession as it existed in the 80s.

At the same time, Krugman is right that long literary treatments of economic phenomena are usually very vague. This can cause them to function as Rorschach tests; each person can interpret Keynes or Minsky or Hayek to mean something a little closer to their desired conclusion. Mathematical modeling precludes that.

On the other hand, the cost of mathematical modeling is that it’s often mathematical tractability, rather than realism, that drives the modeling choices. In other words, bank runs don’t happen exactly like Diamond & Dybvig wrote; they just chose assumptions that made the math relatively easy to solve. This is why models like the ones that one the Nobel this year shouldn’t be regarded as the way financial crises actually work, but simply as ways that they might work. Nailing down exactly how they do work is a task that will be very difficult and take a very long time.

Summers vs. Krugman

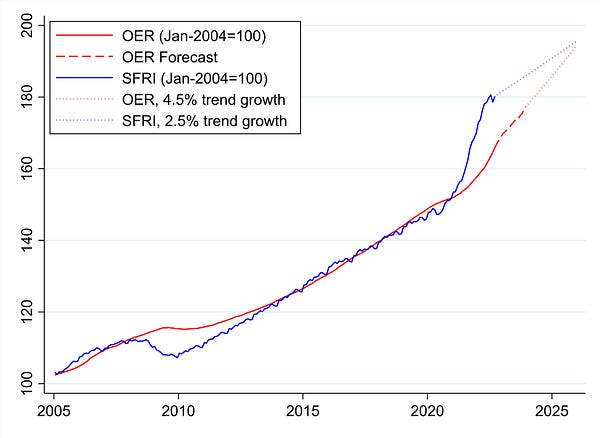

Another interesting econ debate is about inflation. In a recent post, Paul Krugman argued that inflation is coming down faster than we think, because of the lag in the housing numbers; most housing price changes reflect leases signed a while ago, while new leases are increasing at a much slower rate. The implication is that the Fed should be a bit more cautious about hiking rates.

Larry Summers wrote a Twitter thread in response. Some excerpts:

These are very good points. Although the rental price lag effect is probably real, it doesn’t look like that big a deal. The trend in rental prices does look encouraging, but it’ll be a while before it looks safe. And prices are still increasing across the board, meaning that this inflation is broad-based, and requires a systemic remedy. Inflation is still running hot, and the Fed should stay the course.

But at the end of his thread, Summers says something that confuses me greatly:

“Quiet quitting” is a hypothesized phenomenon of people not working very hard at their jobs. There have been a lot of media articles about this theory, but not a lot of evidence, and I don’t think we should draw conclusions about economic policy based on something that might be pure media hype.

More fundamentally, though, it seems to me that Summers gets the math wrong here. Productivity equals economic output divided by hours of work. We’re very good at measuring economic output. If “quiet quitting” has caused actual work hours to decrease in an unobserved way, it means that true labor hours are smaller than the official numbers — meaning that true productivity growth would be larger than we’re measuring in the official statistics. If people are slacking off more and still getting things done, it means that they’re being more productive with the hours they actually work!

That said, Larry is probably right that the Fed will have to cause some kind of recession in order to beat inflation. Hopefully it will be a very mild one.

Interesting piece, glad you talked about inflation. My head is spinning with all the back and forth blaming about what is causing it. Probably all of the above.

In the old days (whenever exactly that was) it seems that inflation was closely paired with higher wages much more than it is today, a la the below commenter. But maybe it is more than we are acknowledging, people seem to have more money, stores are just as full even with sometimes shockingly high prices.

Also, I saw a graph that showed the bottom 25% of income earners had 50% more savings now than they did before the pandemic.

Quiet quitting needs some evidence before it get entrenched as a theory. It assumes that in the past people worked hard in the office and now they don’t.

Since we are talking about knowledge workers, the measure of time as a proxy for output is a problem, especially in engineering and such roles.

Quiet quitting is loosely related to work from home which is assumed to be the tool (unsupervised work) but seems to ignore the productivity gains of cutting out commuting, socializing (with other social impacts), shorter meetings etc.

If we just equate “quiet quitting” with the old “slacking off” then not much is new.

Evidence vs wishful thinking of “sticking it to the man” would really help here and seeing how this evidence changes with tougher economic times and layoffs creates an interesting “lab” to test this hypothesis.