Meme stocks and Bitcoin will not redistribute wealth

Financio-populism is built on dreams and smoke.

“The percentage you're paying is too high priced/ While you're living beyond all your means/ And the man in the suit has just bought a new car/ From the profit he's made on your dreams” — Traffic

I’m trying to resist the urge to keep blogging obsessively about the Ukraine war. So instead today I thought I’d talk about something that’s been nagging at me for a while — the rise of what I call “financio-populism”.

A few years ago, during the ICO mania of 2017, a friend told me about why he’d gotten into Bitcoin. “I never much cared about money,” he said. “But maybe it was because I was getting paid in fiat.” Of course, that shouldn’t really matter — if you get paid in dollars, you can always just turn right around and use them to buy Bitcoin. Instead, I interpreted his statement to mean that for the first time in his life, he was excited about the possibility of building wealth quickly. That’s a very reasonable and common desire, of course, but along with it came a certain rebellious energy. The more I talked to my friend about Bitcoin, the more I realized that he felt like the cryptocurrency offered the common man (or woman) the opportunity to pull ahead of the people who had always had wealth before — the children of privilege, the corporate grinds, the well-connected finance bros. There was a populist energy behind the idea of upending the distribution of wealth.

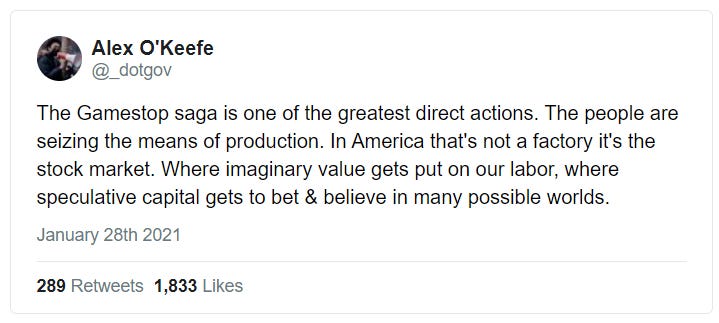

This populism was even more apparent in the GameStop mania of early 2021. People were tweeting stuff like this:

Many people believed that by uniting to defeat the (wealthy, well-connected) traders who had been shorting GameStop, the brave rebels of r/WallStreetBets had finally won one for the little guy. Eric Levitz described the mythos thus:

Last week, a motley mass of shitposters, gambling enthusiasts, and disaffected Zoomers — united by hate for Wall Street and love of chicken tenders — beat a multibillion-dollar hedge fund at its own game. Through their collective intelligence and audacity, users of the Reddit forum WallStreetBets executed a sophisticated “short squeeze” that took money away from some billionaire speculators, gave it to some badly indebted workers, and made a mockery of neoliberal capitalism’s legitimizing myths.

Matt Taibbi summed up the attitude in a post called “Suck It, Wall Street”, in which he claimed that the GameStop mania was “an updated and superior version of Occupy Wall Street”.

Even the name of the platform people used to trade GameStop, Robinhood, evokes redistribution from the rich to the poor. When Robinhood suspended the trading of GameStop shares, even AOC got mad.

The mania didn’t end there. “Meme stocks” are now an asset class unto themselves. Bitcoin is more than twice as expensive as its 2017 peak, and GameStop is still far pricier than in its pre-Reddit existence.

Financio-populism may not excite quite the passion it did last year, but it’s still definitely an undercurrent in modern society. Most recently, it seems to be manifesting in the form of NFT mania.

And I deeply understand the financio-populist impulse. Wealth inequality is at record levels. That wouldn’t be so bad if fortunes rose and fell, and everyone got to spend a little time at the top. But you hardly hear about anyone going from richest to rags these days. There’s always the nagging sensation that the system is rigged — that to get rich you have to have gone to the right East Coast prep school or met the right angel investors at the right parties. In that kind of world, anything that mixes up the set of who’s rich and who’s not can feel like justice.

There’s just one problem — financio-populism is not really going to do this. Yes, we all know that one guy who worked at Starbucks before he got rich on Bitcoin or GameStop, and now drives a Lamborghini. Financial markets are random enough where there will always be that guy. But overall, trading meme stocks and crypto is likely to leave the average person poorer than before. Their dreams will end up lining the pockets of the rich, knowledgeable, and well-connected.

The fundamental fact of financial markets

Finance profs will talk a lot about efficient markets. This hypothesis is not really true — the market has plenty of inefficiencies — but it’s a good concept to keep in mind, because it helps remind people that it’s very hard to consistently make money by trading financial assets.

The real reason why it’s so hard is actually even deeper than efficiency. It’s adverse selection. When someone is eager to sell you something, it’s often a sign that it isn’t worth buying.

In financial markets, there are two sides to every trade. If you see Gamestop stock (GME) priced at $153 a share, it means that someone out there wants to sell it to you at $153 a share. Why? Maybe they’re just unloading the stock because they need some quick cash to pay for a medical bill or their kid’s wedding. But there’s a good chance they believe it’s worth less than $153.

So why do they believe GME is worth less than $153? Are they just idiots? Or do they know something you don’t? Have you digested the news and predicted future demand for GME better than they have? Or have they digested and predicted better than you? How can you tell?

This same principle holds for Bitcoin too, of course. Vast oceans of text have been written by Bitcoin boosters telling stories about why the cryptocurrency will one day be much more valuable than it is. Fiat will inevitably collapse, distributed trust will reign supreme, etc. etc. But every time you buy Bitcoin at $45,000, it means there’s someone out there who owns Bitcoin, but who doesn’t buy those stories.

Economists proved long ago that if everyone was very rational about this, there would be relatively little trading in financial markets. Everyone would always be second-guessing themselves too much to trade. It’s an ongoing topic of debate as to why there is so much trading going on.

The fact is, every retail trader (i.e. non-professional) would probably do well to think a little harder about the question of who is on the other side of the trade, and why. But this principle is also important when we think about financio-populism, and what it does to the distribution of wealth. In order for the trading of assets like GameStop and Bitcoin to shift the distribution of wealth around, the rich people have to be consistently trading with and betting against the normies — and losing.

How likely do we think that is? What we know about the history of financial bubbles suggests: Not very.

The rich get richer off of financio-populism

In fact, the meme stock mania is not the first such episode I’ve witnessed. When I was a teenager in the late 90s, day trading was all the rage, especially for tech stocks. Of course the crash of 2000 destroyed the fortunes of many of these folks, but even before that, very few day traders did better than they would have if they had just bought and held. This is the result of a famous 2000 paper by Brad Barber and Terrance Odean, entitled “Trading Is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors”. They found:

Individual investors who hold common stocks directly pay a tremendous performance penalty for active trading. Of 66,465 households with accounts at a large discount broker during 1991 to 1996, those that trade most earn an annual return of 11.4 percent, while the market returns 17.9 percent…Overconfidence can explain high trading levels and the resulting poor performance of individual investors. Our central message is that trading is hazardous to your wealth.

There’s lots more research on this. A series of papers has studied day trading in Taiwan, where for a while there was no capital gains tax, and where day-trader-specific policies make it easy to tell who’s a day trader. All the papers agree that the vast majority of day traders lose money, although a very small number do consistently beat the market. Evidence from Brazil finds much the same thing.

If regular investors tend to underperform the market average, someone must outperform the average. Sometimes that someone is a lucky gambler or one of those few elite day traders. But most often it’s a skilled professional. Brunnermeier and Nagel (2004) look at hedge funds’ trading activity during the tech bubble and crash in the late 90s, and find that the pros followed the bubble on its way up, then generally managed to sell out at the top, thus turning a tidy profit at the expense of less savvy investors:

[O]ur analysis indicates that hedge funds were riding the technology bubble. Over our sample period 1998 to 2000, hedge fund portfolios were heavily tilted toward highly priced technology stocks…[T]he technology exposure of hedge funds peaked in September 1999, about 6 months before the peak of the bubble…

[W]e find that that the hedge funds in our sample skillfully anticipated price peaks of individual technology stocks. On a stock-by-stock basis, they started to cut back their holdings before prices collapsed, switching to technology stocks that still experienced rising prices. As a result, hedge fund managers captured the upturn, but avoided much of the downturn.

These hedge funds are some of the best in the business (or at least were, back in the 90s), but the average professional asset manager has enough skill to beat the market by a little bit (though not after fees!).

How do they consistently beat the market? Think back to the previous section. If professionals as a group consistently beat the market, then someone must be underperforming. In general, the people who take the losses are…non-professionals.

I.e., retail investors, day traders, meme stock enthusiasts, and so on. In other words, regular folks.

Regular folks don’t always realize this while it’s happening. In the rush of the moment, it may seem like the little guys are overpowering the big guns by uniting and all trading in the same direction. If a vast horde of retail traders buy GME at the same time, the shorts won’t have enough liquidity to resist the horde — they’ll have to give up and exit the market, or buy in and try to ride the wave like the hedgies did in the late 90s tech bubble. So most of the people who bought GME will make money for a time, simply because they forced the price up with collective action.

But eventually this runs out of steam, because the number of people available to buy into the frenzy (or really, the number of dollars) runs out. At that point the price rise reverses itself, just as it did with GameStop. And who loses money at that point? The people who bought in late. It’s like a self-generating Ponzi scheme. My podcast host Brad DeLong, along with three co-authors (including Larry Summers!), theorized about this in the 1990s. And a 2020 paper about Robinhood users by Barber et al. confirmed that this is a regular occurrence with meme stocks:

[W]e find that Robinhood investors engage in more attention-induced trading than other retail investors…While this evidence is consistent with Robinhood attracting relatively inexperienced investors, we show that it can also be partially driven by the app’s unique features…[I]ntense buying by Robinhood users forecast negative returns. Average 20-day abnormal returns are -4.7% for the top stocks purchased each day.

So Robinhood traders keep pumping and then dumping meme stocks. In order for this process to be redistributing wealth from the rich to the poor, the people buying at the bottom have to be the normies, and the people stupidly buying in at the top and getting caught in the very predictable crash must be the rich professionals.

How likely do you think that is? Do you think the hedge fund traders are sitting around cursing all day because they keep buying into meme stock rallies a little too late, only to see their investment collapse again and again? Or do you think they have sophisticated algorithms that can detect ups and downs in Robinhood sentiment early on, allowing them to repeatedly buy at the bottom and sell at the top?

You better believe it’s the latter. Sure, some professional short-sellers got squeezed in the initial GameStop mania. But when the crash inevitably came, it took lots of regular people’s hard-earned savings with it. And pros like Bill Gross who initially lost money in the GameStop rush ended up raking in millions of dollars once the dust settled. Not a very Robin Hood sort of outcome.

And what about Bitcoin? Certainly, many people made vast fortunes when the cryptocurrency came into widespread use — for example, the famous Winklevoss brothers, who now have almost $9 billion between them (still only about 1/9 as much as their old college rival Mark Zuckerberg, but hey). And a fair number of regular folks made out pretty darn well by buying a bit of Bitcoin back in the early 2010s, even if they had less initial capital to invest. (Financial disclosure: I own some Bitcoin and some other cryptocurrencies as well.)

But Bitcoin is a highly concentrated asset — 2% of accounts reportedly hold more than 71% of all the Bitcoin. So while the cryptocurrency has upended the world of the rich, it hasn’t done much to spread the wealth around overall. And the big easy gains may be over now — Bitcoin mining is getting banned in various countries, and it’s facing stiff competition from newer cryptocurrencies like Ether and Solana that guzzle far less electricity and can do fancier things. There will still be lucky investors who buy in early to meme coins like Dogecoin, but this is basically like making a killing on a penny stock — it’s not the kind of thing that is going to benefit a broad swathe of society.

In other words, financio-populism is a pipe dream. Regular folks who put their hard-earned life’s savings into meme stocks or Bitcoin are mostly just feeding the market-beating returns of some hedge fund or crypto whale somewhere. There will always be that random guy with the Lamborghini, but if this country is going to have any kind of wealth redistribution, it’s not going to be via mass participation in casino-like speculative manias.

If you really want to stick it to Wall Street, I say, be a Boglehead. Put your money in cheap low-fee index funds or ETFs and just forget about it for a decade. Let the Wall Street pros do the hard work of determining how much assets are worth, and simply buy the assets for that price and piggyback on their effort.

And if you really want a more economically equal society, vote for leaders who will implement policies to raise the wealth of the broad middle class.

I remember when people mined bitcoins in the college computer lab. Originally, you were supposed to get compensated for making the network function with bitcoins. But that is so difficult now, only people with a lot of compute power can mine anything. In other words, people that already have a lot of money. Not exactly a mechanism for redistribution.

Thank you for writing this. I just talked to someone at a crypto conference who wanted to sell NFTs to help indigenous villagers in Peru, and I was trying to explain to him why doing that would solve a problem more for investors (increasing social status, vanity) that for villagers. It's not that more money and better financial literacy wouldn't help those villagers, but that there are simpler and more direct ways to help them, i.e. increasing their access to fast internet and clean water.

Crypto's real game changer as a technology is enabling creators (of anything) to bypass middlemen in distributing their assets. Founders can now list their tokens on a decentralized exchange and bypass traditional venture capital. Artists can now list their art on an NFT marketplace and bypass auction houses like Sotheby's. Non-profits should be able to turn themselves into self-sustainable DAOs by using smart contracts to lower operating costs and tokens to boost fundraising. Not to shill, but I tried to explain this in https://fengtality.substack.com/p/what-is-the-job-of-crypto.