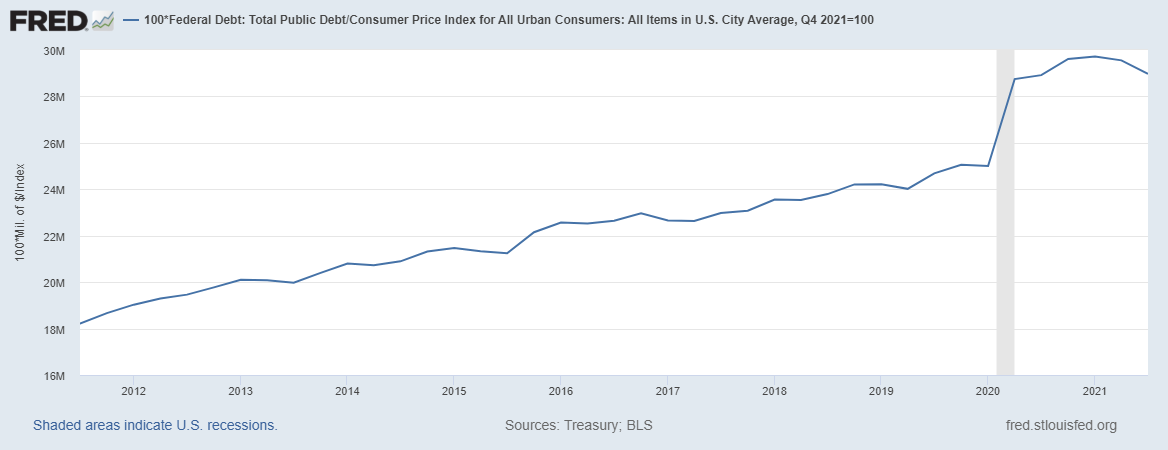

The other day, I was writing about inflation and the national debt, and a commenter asked me whether inflation had caused the debt to go down in real terms. I checked, and to my surprise, I found it had! From the first quarter of 2021 to the third quarter, despite two huge Covid relief bills — the $0.9 trillion bill in December 2020 and Biden’s $1.9 trillion bill in March — the national debt actually fell in inflation-adjusted terms:

I’ve talked a lot about the effect of inflation on wages, and the danger that it could explode and damage our economy. But there’s one other important effect of inflation that I haven’t talked much about. Inflation erodes debt. And this has important implications for the distribution of wealth in our society.

The monetary economist Narayana Kocherlakota once said that “money is memory”. If so, inflation is forgetting. By reducing the value of a dollar, inflation makes every economic transaction that happened in the past mean less. When inflation happens, every dollar you owe, and every dollar someone owes you, means less in terms of the real physical things that matter — in terms of months of rent, loaves of bread, hours of labor. And thus the record of the financial past — of the dollars you accumulated, borrowed, and lent out — gets gradually wiped away.

It’s not clear whether this is a bad thing or a good thing, overall — obviously it depends on your point of view. To conservatives, inflation may seem like a cheat card, allowing the spendthrift to avoid ever paying back the full value of what they consumed. To progressives, inflation’s erosion of debt might seem like a blessing — a wealth tax for the rich and a partial debt jubilee for the poor.

And there are subtler effects on the economy’s productive potential — effects we don’t entirely understand yet. If inflation can be contained, it could help make the national debt more sustainable over time, actually reducing the chance of a future hyperinflation. And by eroding the overhang of private-sector debt built up before the Great Recession, it could eventually prime us for faster growth. But neither of these is very certain.

So let’s think a little more about how inflation erodes each type of debt, and what this means for the economy and the various actors in it.

How inflation erodes government debt — and what that means

Keep reading with a 7-day free trial

Subscribe to Noahpinion to keep reading this post and get 7 days of free access to the full post archives.