Discover more from Noahpinion

I always resisted becoming one of those pundits who writes about the monthly economic numbers. But the inflation of 2021-22 is interesting enough economically and important enough politically that I’ve eschewed my usual policy of restraint. There’s only so much we can learn from each monthly data point, but that’s just as true of the Fed and of all the businesses who are responsible for actually setting prices in the economy. It’s a case when everyone has to react quickly without full information.

Anyway, instead of trying to weave everything into a big thesis, I’ll just lay out a quick series of bullet points here.

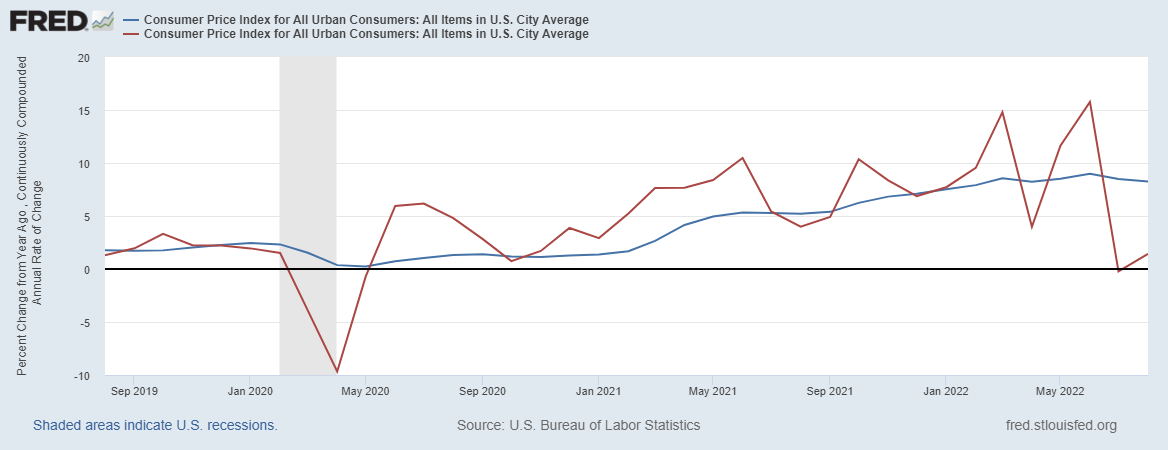

Headline inflation is low month-over-month but still high year-over-year

In last month’s inflation post, I explained the difference between year-over-year and month-over-month numbers for inflation. These are both perfectly valid measures of inflation; neither one is more “true” or “real” than the other. They simply give us slightly different bits of information, so it’s good to look at both. Basically, month-over-month is a short-term number that bounces around a lot, but gives us an early heads-up warning when inflation is accelerating or decelerating, while year-over-year is a more stable number.

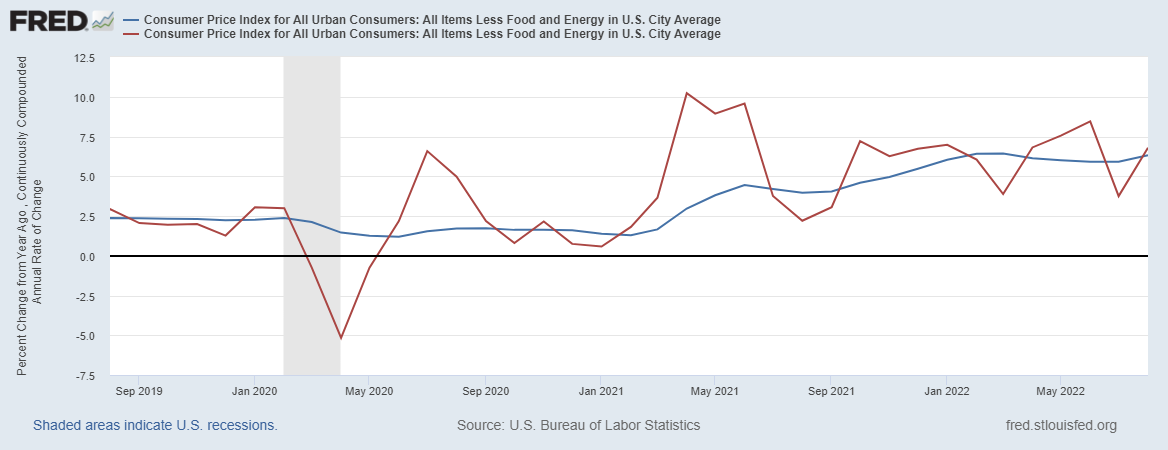

In July, these two numbers diverged. Basically, prices overall didn’t increase much between June and July, but they had increased so much since summer 2021 that the year-over-year numbers were still high. That pattern was exactly the same in August:

Those two lines you’re looking at actually show the exact same data, presented in two different forms. Month-to-month inflation was barely above zero, but that still left year-over-year inflation at 8.3%.

Theoretically, that difference could put the Fed in an interesting situation. Standard macroeconomic models just say the Fed should respond to “inflation”; they don’t really say whether that means m/m or y/y. Which one is more important depends on how fast businesses reset their expectations based on new data, which is something macroeconomists don’t really know yet. The Fed’s actual decision-making process may take both numbers into account.

But in fact, the situation is much simpler for the Fed, because headline inflation isn’t what they care about most. What they care about most is core.

Core inflation is high

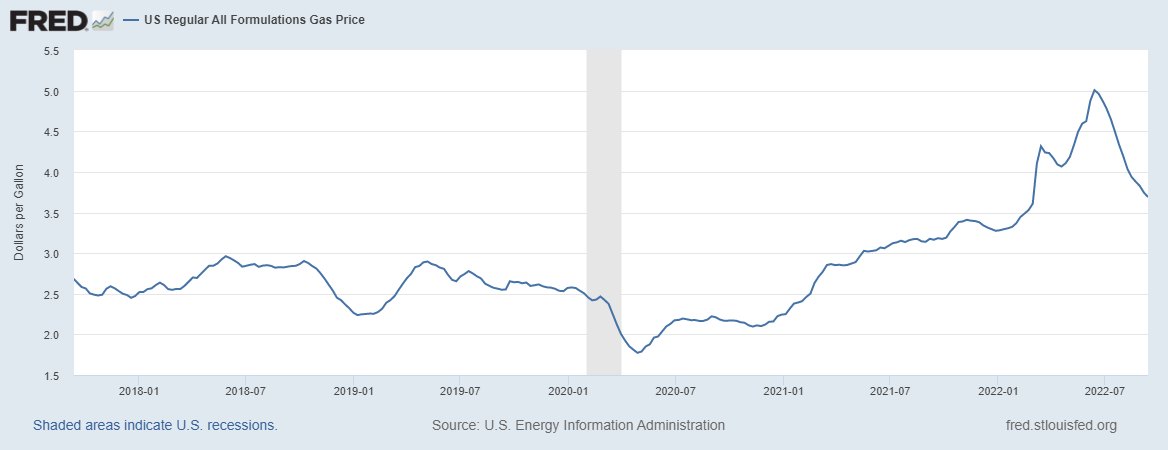

Core inflation is inflation without energy and food prices taken into account. The rationale for this is that energy and food prices bounce around a lot — if you don’t like this month’s gas price, just wait a month and it’ll change.

That’s exactly what seems to have happened with U.S. inflation. Gas prices are way down from their peak, headed toward 2021 levels:

This is due to a two factors: falling oil prices, and a drop in refinery profits.

Falling gas prices are a political win for the Biden administration, since Americans care about gas prices even more than they care about other forms of inflation. Indeed, Biden’s approval ratings are rising, and Republicans are hedging their bets on their inflation messaging for the midterms.

But what the Fed mainly cares about — and what it officially targets — is core inflation. And core inflation remained high in August, both in month-over-month and year-over-year terms:

This number is supposed to be at 2%, and instead it’s running at about 6-7%. That is not going to be acceptable to the Fed, for reasons I’ll get to in a bit.

Did the Fed’s previous rate hikes have an effect?

One interesting question is whether the Fed’s previous rate hikes have managed to slow inflation:

In fact, there’s a good chance that the rate hikes have had a major effect. Core inflation was accelerating all throughout 2021, but since the start of this year it has been steady at around 6-7%. That’s not total victory, but it’s a heck of a lot better than continued acceleration. Remember that the really scary situation is an explosive spiral where inflation just keeps going up and up. For now, the Fed looks to have prevented that.

And also, remember that by many measures, interest rates just aren’t that high yet. A classic Taylor Rule would have them be several percentage points higher than they are. There are two reasons rates aren’t that high yet:

The Fed tends to raise rates gradually instead of all at once, probably mostly out of fear of disrupting financial markets.

The Fed probably expects falling energy prices to eventually feed through to core inflation, since energy is a big input into the production of durable goods.

But as long as core inflation persists well above targets, we should expect rates to keep going up. They could conceivably get a lot higher than they are now.

Inflation is broad-based

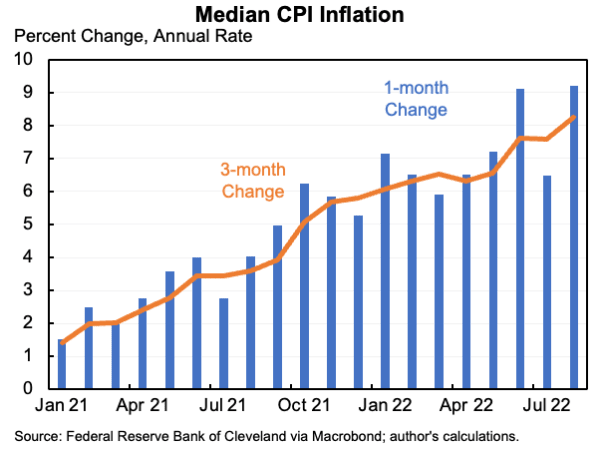

One other reason to worry about inflation is that it’s extremely broad-based. To see that, we can look at median inflation. This measure ignores any good or service that had a big price swing last month. Median inflation is very high, and in fact might still be accelerating:

This indicates that inflation isn’t mostly just one thing. A lot of macro pundits like to focus on specific components of the CPI — rent, or used cars, or whatever. They do this either because it allows them to downplay the importance of inflation, or, more likely because it gives them a lot more material to write about.

Since this inflation began in 2021, we’ve seen lots of this. At first inflation was just lumber, then it was just used cars and computer chips. Now a lot of people are focusing on the rent number. But the median inflation numbers tell us that this micro focus is misplaced. The current inflation is not just a few items; it’s a broad-based phenomenon being driven by macroeconomic forces.

The Fed is probably willing to tolerate a mild recession, and that’s fine

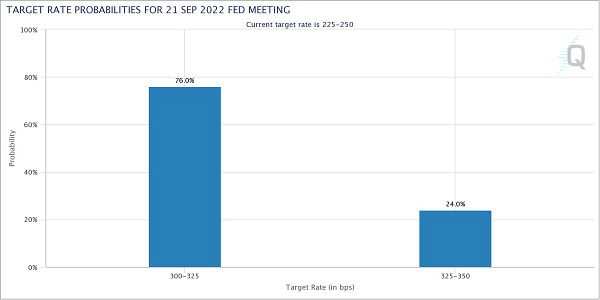

All this brings us to the question of what the Fed will do in response. And the answer is “keep hiking interest rates”. When headline rates started falling, some people expected the Fed to ease up a bit with a 50bp rate hike at the next meeting (which is a week from now). Now, given the persistently high core numbers, people are expecting 75bp or even 100bp:

And here’s what Chris Waller had to say about where rates might end up:

Consider the way Fed Governor Christopher Waller described his decision tree Friday at a question-and-answer session for the Institute for Advanced Studies in Vienna, Austria:

Scenario No. 1: If inflation follows the June Summary of Economic Projections: “In that case, I would support our policy rate peaking near 4%.”

Scenario No. 2: If inflation doesn’t slow or rises further: “Then in my view the policy rate will probably need to move well above 4%,” he said, emphasizing the words “well above.”

Scenario No. 3: If inflation decelerates quickly: “Then in my mind the policy rate might peak at less than 4%.”

For the Fed, the most important issue here is probably credibility. If people start thinking the Fed is soft on inflation or doesn’t take its own target seriously, it would mean that the Fed would have to hike rates much higher — and cause much more economic pain — in order to bring inflation down in the future. This is basically what happened in the 70s, and everyone wants to avoid a repeat of that. Better to cause a mild recession now than to be forced to cause a deep, Volcker-like recession in a few years.

On top of that, there’s a utilitarian calculation here. Inflation hits everyone, while the unemployment from a recession hits only a few people. And it’s fairly easy for the government to provide relief for the unemployed than to provide relief to all of society during a period of inflation (this is because if you try to cut people checks to help them buy stuff, it just makes the inflation worse). So a mild recession is just less harmful to human welfare than persistent high inflation.

We’d all like to see a “soft landing”, where the Fed manages to raise rates just enough to get rid of inflation without any increase in unemployment. But a mild recession, similar to the 2001 recession, is the next-least-bad outcome.

The Fed isn’t going to bail out the stock market

A few figures in the tech world have become worried that Fed rate hikes will cause a deep recession:

Deflation would require a severe recession or a depression. That’s exactly what I hear some people talking about:

This is extremely unlikely. Volcker’s big recessions required rate hikes all the way to 20% (we’re currently at 2.5%), and those didn’t come anywhere close to causing deflation.

More likely, what tech people are worried about is the stock market. There was a massive crash in tech stocks a few months ago, and the market has not recovered. This affects the wealth (and fundraising ability) of founders, and it affects the compensation (and hiring) of tech employees. If the Fed continues hiking rates, it will weigh heavily on the market, exacerbating these issues.

But although we got used to equating the stock market with the real economy, the two aren’t the same, and it’s the latter that the Fed cares about. As long as inflation is high, the Fed will not worry about bailing out anyone’s portfolio:

I don’t expect the Fed to stop firing at inflation until it no longer sees the whites of inflation’s eyes.

Someone should tell Elon that worrying about deflation is like worrying about overpopulation on Mars

This is an excellent summary. One interesting question is the degree to which a decline in asset prices due to rate hikes will affect the real economy. I suspect that a prolonged decline in household wealth would be a significant cause of a cooling off of the economy and of inflation.